Edmonton Real Estate Market Update – June 2025

Strategic Calm. Measurable Shifts. And New Buyer Leverage.

The Edmonton real estate market just hit a turning point—again. Median prices are up $20,000, active listings have climbed 15% from this time last year, and the absorption rate? It’s dropped to levels we haven’t seen since 2022. Buyers are finally breathing easier—and that’s reshaping everything. But don’t get too comfortable. This balance might be temporary.

Let’s break down what’s shifting, what’s holding strong, and what this all means for your next move.

📍 Greater Edmonton Market – Holding Steady, Gaining Balance

In June 2025, 2,877 homes were sold across the Greater Edmonton Area. That’s a slight 2.8% dip from May, but still up 1.2% year-over-year. Sellers added 4,215 new listings, which is fewer than last month,

but 15.8% more than June 2024. That’s a sign that listing confidence is alive and well—even as the pace cools.

The absorption rate now sits at 68%, a drop from 78% last June, confirming a slower (but not stalled) market. Inventory is up to 6,768 active listings, giving buyers more room to negotiate

and giving sellers a new challenge: stand out or sit still.

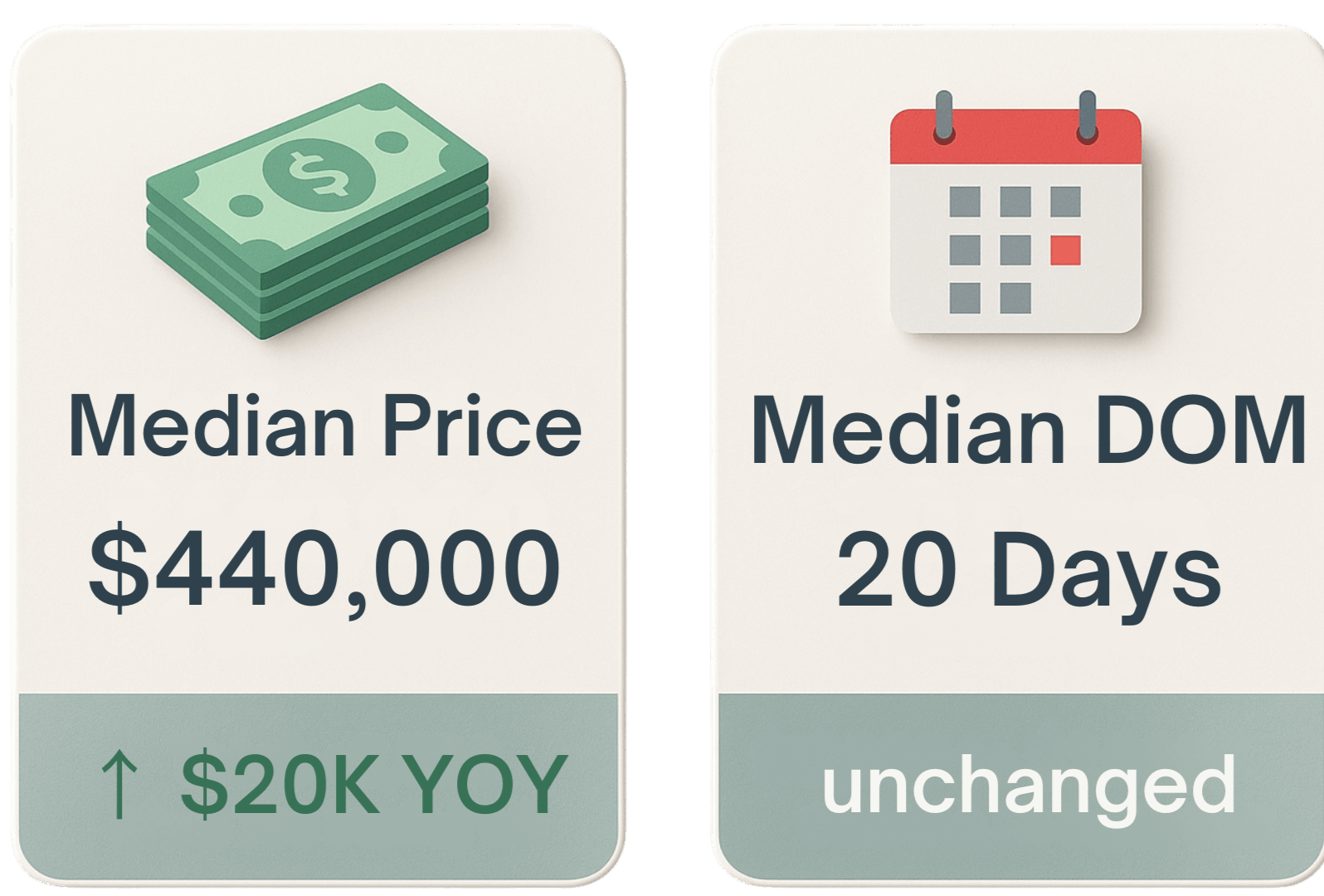

Prices remain resilient. The median residential sale price is $440,000, flat month-over-month but up $20,000 from June 2024. Median days on market? Still 20 days.

That’s stability, not softness.

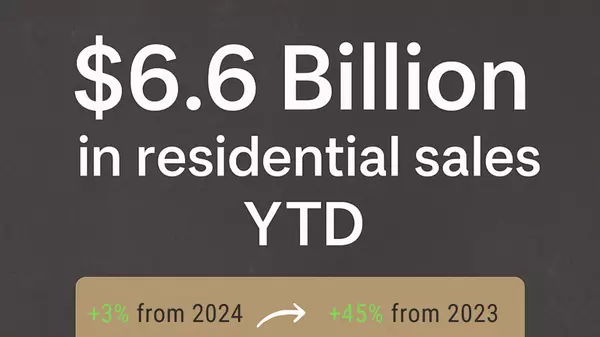

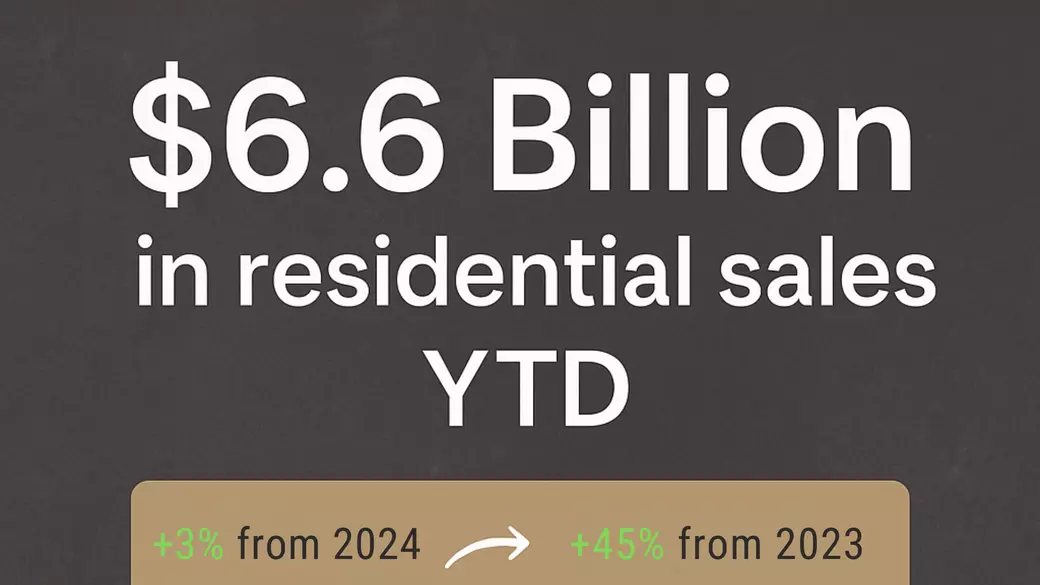

Halfway through the year, total residential sales volume has surpassed $6.6 billion—3% ahead of 2024 and a remarkable 45% above mid-2023. The activity is still there. It’s just no longer frantic.

🏠 Detached Homes – High Value, Slower Tempo

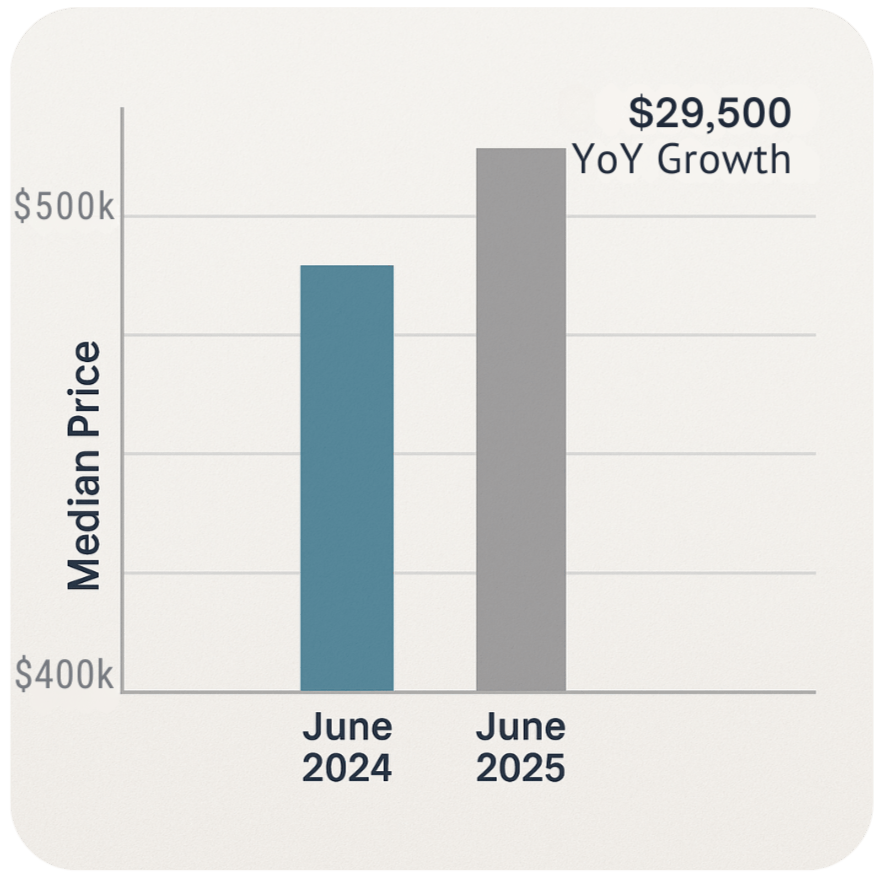

Detached homes continue to anchor the market. In June, the median sale price hit $524,500, up from $495,000 last year—an impressive $29,500 equity gain year-over-year.

The median days on market stayed at 19, slightly slower than May but consistent with June 2024. The absorption rate for detached homes came in at 69%,

signalling a step down from 2024’s ultra-competitive market, but still indicating healthy demand.

🔑 Key insight: Detached homes under $500,000 are still moving fast. First-time and move-up buyers are targeting this range hard,

and well-priced listings in this bracket often sell within two weeks, sometimes with limited negotiation.

For sellers? Strategic pricing and clean presentation are non-negotiable. For buyers? You’ve gained breathing room—but speed still matters in that sub-$500K zone.

🏡 Semi-Detached Homes – From Urgency to Value

If there’s a segment where the market is visibly shifting, it’s semi-detached homes.

Prices are still growing: the median hit $430,050, up from $411,000 last June. But supply has surged—new listings rose 26.5% year-over-year, while sales fell 9.3%.

The absorption rate dropped to 68%, a dramatic shift from 94% last June—one of the steepest cool-downs in Edmonton’s housing segments.

Yet, median days on market held at 17.

This isn’t a crash. It’s a recalibration. Buyers are negotiating harder, and they’ve got options. Sellers with homes over $450K or in need of updates are seeing slower traffic.

But homes with strong layouts and thoughtful upgrades are still moving—especially when priced under $450K.

🧠 Bottom line: It’s no longer a segment driven by urgency. It’s driven by clear, visible value.

🏘 Row & Townhomes – Value Holding, Pace Slowing

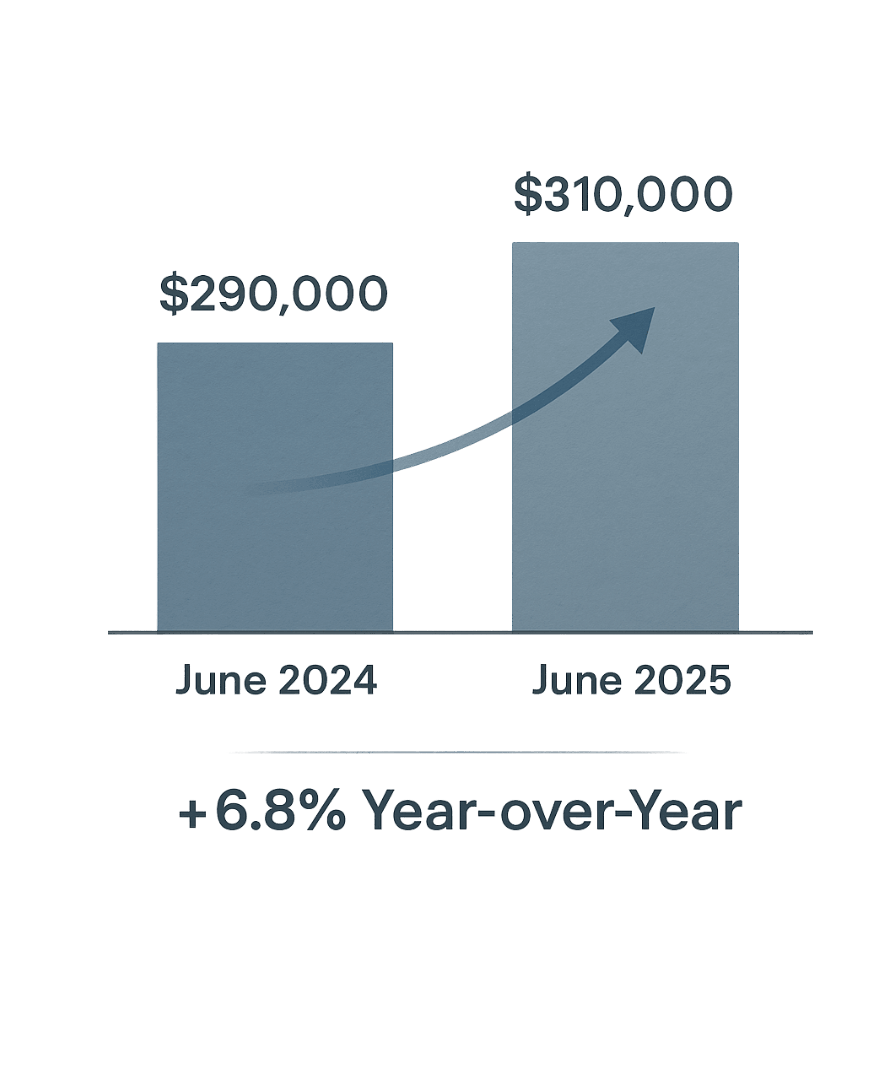

Row and townhomes remain one of Edmonton’s most resilient segments. The median price hit $310,000, up from $290,000 in June 2024—a 6.8% year-over-year increase.

But momentum is softening. The median days on market rose to 20, and the absorption rate dipped to 77%, down from 86% last year.

Still, this category remains a go-to for buyers under $325K looking for newer, move-in ready homes.

Homes near the $300K psychological sweet spot with clean presentation and solid locations are seeing steady movement.

📉 For sellers: "List high and wait" won’t fly anymore.

📈 For buyers: This is one of the few areas where smart shopping still gets you affordability, space, and function.

🏢 Condos – Slowest Segment, Steady Momentum

The median sale price for condos held at $195,000—unchanged from both last month and June 2024. While that may feel stagnant, it’s actually a signal of resilience.

Condos took the longest to sell (30 days median DOM), but the absorption rate of 60% still beats 2023’s 58% and 2022’s 46%.

That’s three years of upward absorption trend—a quiet signal that demand is gradually returning.

💡 Buyers: This is the calmest segment. You can often find units under $250K, with time to inspect, negotiate, and think clearly.

💡 Sellers: Quality matters. Updated units in well-run buildings still move. Outdated units with high condo fees? Not so much.

The condo market isn’t flashy—but it may be the most stable of them all.

🎯 What This Means for You

If you’re buying:

This is your moment to act without pressure. Most property types are giving you more time and more options—especially in that $400K–$500K zone. But don’t wait too long on well-priced listings. They’re still moving.

If you’re selling:

It’s not just about listing—it’s about strategy. Homes priced within 1–2% of true value, staged properly, and aligned with current buyer expectations are still selling clean. But overpricing by even $10–15K? That can cost you weeks on market and downward adjustments later.

🧠 This is a smart market—not a scared one. And in a smart market, preparation wins.

📥 Want to Know What’s Happening in Your Neighbourhood?

The big picture is one thing—but every community tells its own story. If you're curious about what's happening on your block or want clarity on your home's current value, reach out anytime. I’m always happy to break down the numbers and give you a clear, pressure-free perspective.

Categories

Recent Posts