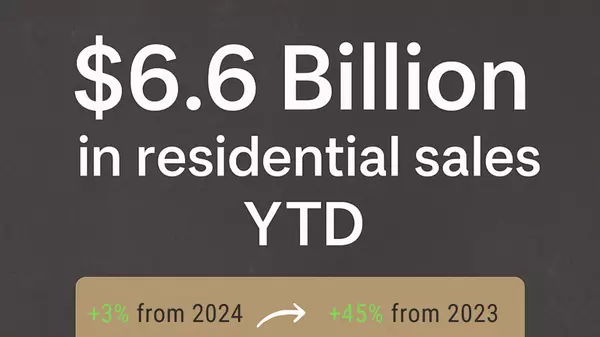

Edmonton Real Estate Market Update: February 2025 – Key Trends for Buyers & Investors

As we move further into 2025, the Greater Edmonton real estate market is showing signs of momentum, with rising home prices, increased sales activity, and shifting opportunities for investors. Whether you’re a homebuyer looking for the right time to enter the market, a seller debating when to list, or an investor searching for strong returns, this breakdown of February 2025’s real estate trends will give you the insights you need.

This update covers a side-by-side comparison of market conditions, looking at how February 2025 compares to January 2025 and February 2024—so you can see the long-term trends and short-term shifts that impact buying and selling decisions.

Why Median Price Matters More Than Average

Before we jump into the numbers, let’s talk about why using the median price is more accurate than the average price in real estate reporting.

- Median price represents the middle point of all sales, meaning that half of the homes sold for more and half sold for less.

- Average price can be skewed by a few high-end luxury homes or ultra-low-priced sales, which distorts the true market picture.

💡 Example: If 10 homes sell and one of them is a $3 million luxury property, the average price will be artificially inflated, while the median price will reflect the actual middle of the market, which is what buyers and investors should focus on.

Using median pricing gives a clearer and more reliable view of home values and buyer activity in the market.

Edmonton Housing Market Snapshot

📊 Total Residential Market

- Median Sale Price: $435,000

- Up 9.3% YoY (from $398,000 in Feb 2024)

- Up 4.1% MoM (from $417,700 in Jan 2025)

- Sales Volume: $820M

- Up 2.5% YoY (from $800M)

- Up 17% MoM (from $700M)

- Sales-to-New Listings Ratio: 67%

- Flat YoY, but up from 65% in Jan 2025

- Median Days on Market: 19 days

- Faster than 28 days last year

- Faster than 34 days in January

What This Means:

- Homes are selling faster than they were last year and last month.

- Price growth is strong, showing rising buyer and investor confidence.

- Competition is increasing, meaning buyers need to move quickly to secure good properties.

Detached Homes: Still the Hottest Segment

📍 Detached Market Breakdown

- Median Sale Price: $530,000

- Up 14% YoY (from $465,000)

- Up 2.9% MoM (from $515,000)

- Sales Volume: $576M

- Down 1.9% YoY, but up 20% MoM

- Median Days on Market: 19 days

- Faster than 28 days last year

- Faster than 40 days in January

- Sales-to-List Price Ratio: 100%

- Flat YoY, but up from 99% in Jan 2025

Key Takeaways for Investors & Buyers:

- Detached homes continue to appreciate the fastest, making them a top choice for long-term investors focused on appreciation.

- Demand is outpacing supply, with homes selling much faster than last year and last month.

- If you’re buying, be prepared for strong competition—many listings are receiving multiple offers.

Semi-Detached Homes: Strong Growth with Fast Sales

📍 Semi-Detached Market Breakdown

- Median Sale Price: $425,115

- Up 9.5% YoY (from $388,000)

- Up 1.2% MoM (from $420,000)

- Sales Volume: $90M

- Up 21% YoY, Up 7% MoM

- Median Days on Market: 15 days

- Faster than 23 days last year

- Faster than 26 days in January

Why Semi-Detached Homes Are a Good Investment Right Now:

- Lower price point than detached homes but still experiencing strong demand.

- Shorter days on market mean that investors can quickly place tenants.

- Steady price growth shows continued appreciation potential.

Townhouses: Affordable & In Demand

📍 Townhouse Market Breakdown

- Median Sale Price: $305,000

- Up 7% YoY (from $285,000)

- Down 4.7% MoM (from $320,000)

- Median Days on Market: 17 days

- Faster than 25 days last year

- Faster than 25 days in January

What This Means for Investors & Buyers:

- Affordability + Low Vacancy = Strong Cash Flow Potential.

- The slight dip in price month-over-month could be a short-term buying window before prices rebound.

- Townhouses offer a great mix of affordability and rental income potential.

Apartment Condos: Big Gains & High Rental Demand

📍 Condo Market Breakdown

- Median Sale Price: $198,500

- Up 18% YoY (from $168,000)

- Up 9.1% MoM (from $182,000)

- Median Days on Market: 30 days

- Faster than 38 days last year

- Faster than 41 days in January

Why Investors Should Pay Attention to Condos:

- Most affordable entry point in the market, making them ideal for long-term rentals or Airbnb investments.

- Rising rental demand means that securing a high-demand rental unit can lead to strong cash flow.

- Significant year-over-year appreciation suggests that condos are regaining popularity among buyers.

Final Thoughts: Where Is Edmonton’s Market Heading?

The Edmonton real estate market remains strong, with fast sales, rising prices, and continued demand across multiple property types.

📢 Key Takeaways:

- Detached homes remain the top appreciation play, but require stronger competition to buy.

- Semi-detached homes and townhouses offer solid investment potential with fast-moving sales and growing demand.

- Condos are seeing some of the biggest percentage gains, making them a viable option for affordability-focused buyers and rental investors.

If you're considering buying, selling, or investing, now is the time to plan your strategy.

💬 Want to discuss your real estate goals? Reach out today for expert advice and insights tailored to your needs!

Categories

Recent Posts