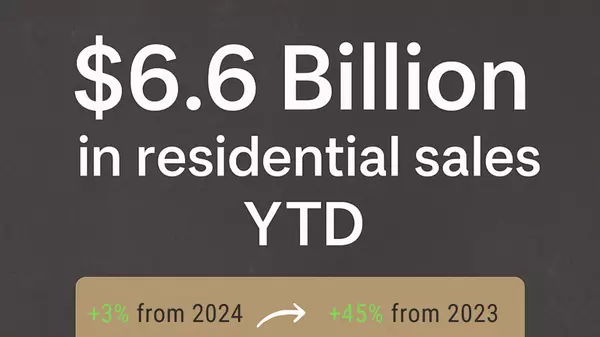

Why 2025 is the BEST Time to Buy a Home in Edmonton

The Edmonton real estate market in 2025 is full of opportunities for buyers, sellers, and investors alike. With home prices still reasonable compared to other major Canadian cities—and despite interest rates seeing a slight uptick—now is the time to take action.

If you’re considering buying a home, Edmonton’s unique affordability, growth potential, and market trends make it one of the most promising places to invest in real estate this year.

🎥 Want a quick overview of why 2025 is your year to buy? Watch my YouTube video here:

👉 Why 2025 is THE Year to Buy a Home in Edmonton!

In the video, I dive deeper into:

- Why Edmonton remains Canada’s affordability leader,

- How mortgage rates impact your buying power,

- And the hidden costs of waiting too long to buy.

Let’s break it all down further below.

Affordable Prices—But the Clock is Ticking

Edmonton continues to stand out as one of Canada’s most affordable cities. The average home price in Edmonton is still under $450,000, a stark contrast to cities like Vancouver or Toronto, where even a small condo costs over $1 million.

However, experts predict 3-5% appreciation in property values in 2025, driven by increasing demand and shrinking inventory. That means the window to lock in these prices is closing fast.

Example: If a $450,000 home appreciates by 5%, it will cost $472,500 by the end of the year—an extra $22,500 out of your pocket. Waiting could cost you significantly more when factoring in higher monthly payments and down payment requirements.

What’s Happening with Mortgage Rates in 2025?

Interest rates saw an increase over the past year, with current rates hovering higher than the lows we enjoyed in the early 2020s. While this has created some hesitation among buyers, the reality is that stabilizing rates still present a favorable opportunity to buy.

Why Now?

- Higher Rates, but Lower Competition: Slightly higher rates have discouraged some buyers, meaning less competition for the best homes on the market.

- Lock in Stability: While rates may fluctuate in 2025, locking in a mortgage at today’s rate ensures your payments are predictable—no matter what happens next.

For example:

- A $450,000 home at today’s rate of 6.5% translates to a monthly payment of about $2,400 (based on a 25-year amortization). While higher than the 2020 lows, this still positions buyers to build long-term wealth as Edmonton home values rise.

The Cost of Waiting: Don’t Let Time Work Against You

Some buyers may think waiting will give them more flexibility or better rates. Here’s why that strategy could backfire:

- Rising Prices: As Edmonton home values appreciate, you’ll pay more for the same property if you wait.

- Higher Down Payments: A 5% price increase means you’ll need thousands more just to meet minimum down payment requirements.

- Missed Equity: Real estate is one of the few investments that builds equity over time. Buying sooner means you’ll start building wealth immediately, rather than paying someone else’s mortgage if you’re renting.

Why Edmonton Real Estate Stands Out in 2025

While other Canadian cities grapple with extreme home prices, Edmonton offers a unique combination of affordability and growth. Here’s what makes Edmonton the perfect market for homebuyers and investors:

- Affordable Detached Homes: You can still find a spacious detached home for under $500,000—unheard of in most major cities.

- Interprovincial Migration: More Canadians are relocating to Alberta, seeking lower costs of living and better job opportunities.

- Job Growth: Edmonton’s economy continues to expand, with opportunities in energy, technology, and healthcare.

- Future Appreciation: The city’s steady growth and infrastructure investments make it a strong long-term bet for property value gains.

How to Start Your Edmonton Homebuying Journey in 2025

If you’re ready to make 2025 the year you achieve homeownership, here’s how to start:

-

Get Pre-Approved for a Mortgage:

- Work with a lender to understand your budget and lock in today’s rate.

- Being pre-approved also strengthens your position when making an offer.

-

Work with a Local Realtor:

- Edmonton’s market is competitive—partner with a real estate expert who understands local trends and can help you find the right home at the right price.

-

Set Your Priorities:

- Identify what matters most: location, home size, or specific features. Knowing your must-haves makes the search process more efficient.

Need More Expert Insights? Watch My Latest Video!

For a deeper dive into Edmonton’s real estate trends, watch my latest YouTube video:

🎥 Why 2025 is THE Year to Buy a Home in Edmonton!

In the video, I explain:

- Edmonton’s affordability advantage,

- How mortgage rates affect your buying power,

- And why acting now sets you up for long-term success.

Subscribe to my channel for weekly real estate tips, market updates, and more.

Final Thoughts

The Edmonton housing market in 2025 offers unique opportunities for buyers ready to act. Despite slightly higher interest rates, the combination of affordability, appreciation potential, and growing demand makes this year an ideal time to purchase.

If you’re ready to get started, reach out today. Whether you’re a first-time buyer or upgrading to your dream home, I’d love to help you navigate Edmonton’s real estate market.

And don’t forget—subscribe to my YouTube channel for more expert advice on buying a home in Edmonton!

Categories

Recent Posts